Changing revenue models

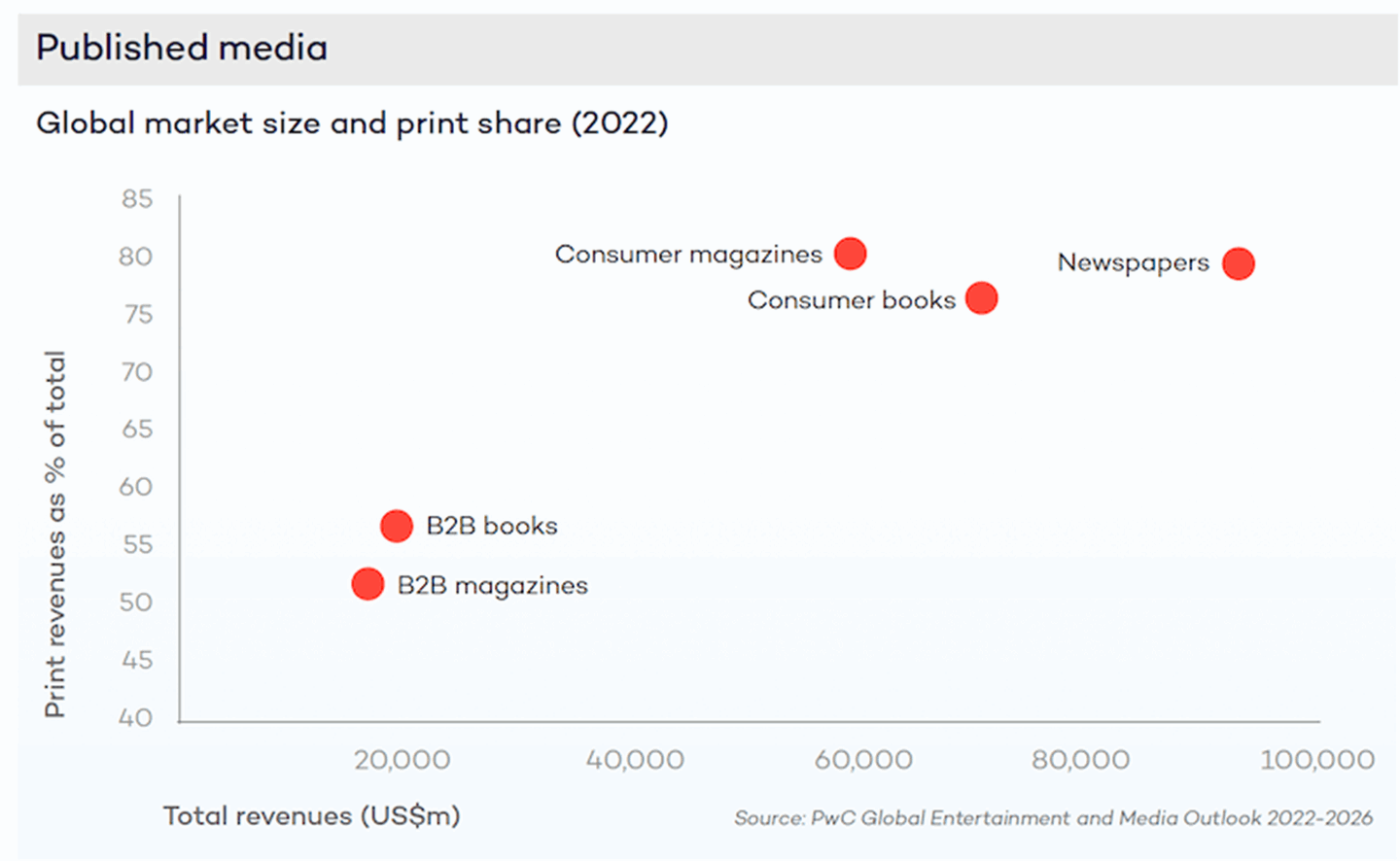

The traditional business model for magazines has evolved significantly. Houston points out that magazines are no longer solely dependent on advertising revenue; instead, they are increasingly embracing subscription models and direct-to-consumer sales. "For a magazine to survive, it needs multiple revenue streams," he asserts, echoing sentiments from industry leaders who advocate for a more holistic approach to monetisation.

The shift towards viewing print as a premium product is also noteworthy. As Houston explains, "People are willing to pay more for high-quality print because they receive something unique and tangible." This premium positioning allows publishers to charge higher prices while delivering less frequent but more curated content. The success of independent publications that focus on quality over quantity exemplifies this trend

The role of digital in discovery

Despite his enthusiasm for print, Houston acknowledges the necessity of digital tools in promoting and selling print products. He emphasises that publishers must enhance their digital presence to drive discovery and sales. "Independent print can probably only survive through digital e-commerce or social media for discovery," he explains. This dual approach—leveraging both digital platforms and high-quality print—creates opportunities for growth and engagement.

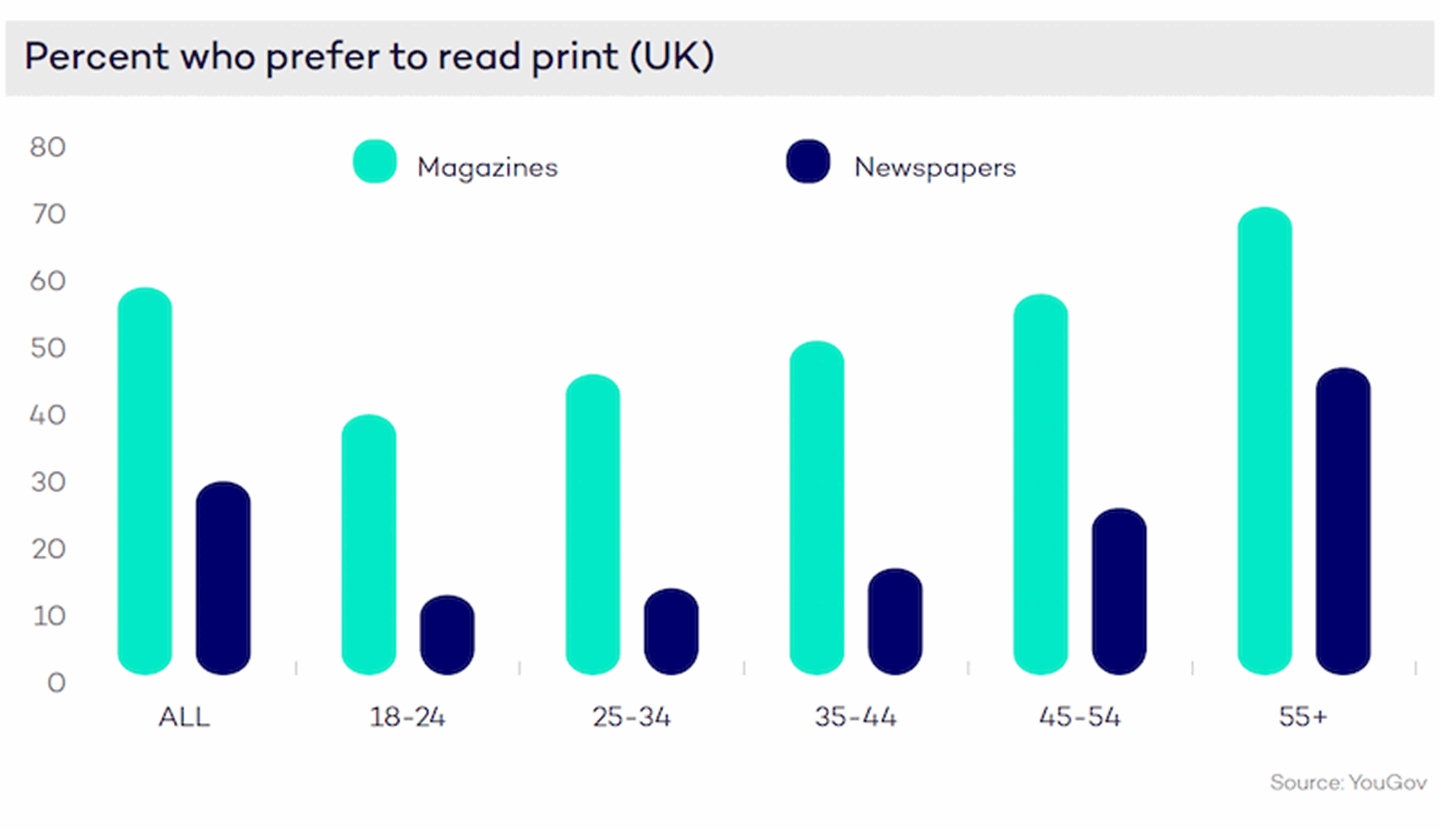

Houston also highlights an interesting phenomenon among younger generations like Gen Z and Gen Alpha. He observes a growing disillusionment with screens and digital content, noting that these audiences are increasingly valuing the tactile experience of reading from paper. "I see those generations recognising how much better the print experience is for reading and retaining information," he remarks. This shift could signal a resurgence in interest for printed materials among younger consumers who seek alternatives to the overwhelming digital noise.

Distribution challenges

While there are positive indicators for the future of print, challenges remain—most notably in distribution. Houston points out that many consumers struggle to find their preferred magazines in physical stores due to dwindling shelf space and fewer (retail) outlets carrying diverse titles. "The irony is that publishers need to do digital better for discovery," he states, advocating for improved online marketing strategies to reach potential readers.

Moreover, he stresses the importance of building direct relationships with consumers through email newsletters and social media platforms. By fostering these connections, publishers can drive traffic to their websites and encourage sales of both subscriptions and single issues.

For more examples of why the future of magazines is exclusive, premium and niche, sign up to our newsletter.